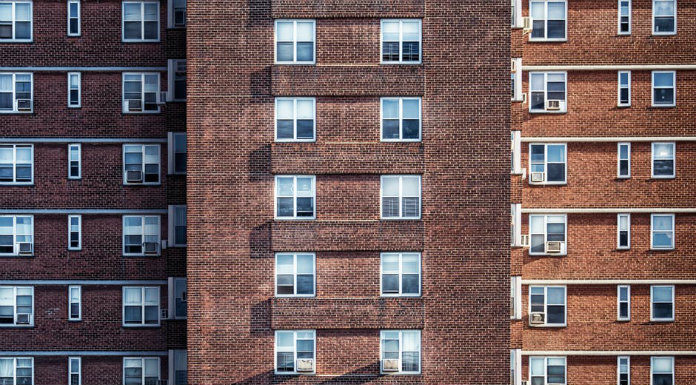

Concern is being expressed in Clare that first-time buyers could face a 10-year battle to scrape together a mortgage deposit, as the rental crisis deepens.

Daft.ie’s latest report shows that the average cost of renting a home in Clare has now risen to €771 per month, a 9% rise in a year.

Now the concern is that this is leading to a serious burden on those looking to get their foot on the property ladder.

Since 2014, there’s been an almost 50% rise in the average cost of renting in Clare.

The past year alone has seen a 9% rise in this county and a 12.4% rise nationally and while prices rise, the number of available properties is remaining stagnant.

According to their website, there are just 53 homes available to rent across the entire county today, ranging from €500 per month to well over €1,000.

Economist and author of the report Ronan Lyons says the supply issue is beginning to fix itself in the sales market but for renters, it’ll take longer to rectify:

However, it’s led to concern about the knock on impact of the difficulties in the rental sector on prospective buyers.

Douglas Hurley of DNG O’Sullivan Hurley in Ennis says it’s putting huge pressure on those trying to enter the property market.

The report has also led to fresh calls for rent pressure zones to be extended countrywide.

As things stand, just 21 areas are covered by the zones, which limit the amount by which landlords are legally allowed to hike the monthly rent.

The vast majority are in Leinster but CEO of housing charity Threshold, John Mark Mc Cafferty, says many more places should be included.